Cape Coral Florida Real Estate News

April 29,2018

State and National News:

- Inventory plummets in the lower price points Read more…

- Doggone confusion over service, support animals Read more…

- How to triumph in a bidding war Read more…

- Builder trend: Homes that adapt and change with us Read more…

- Fla. Building Permits rose 20.8% year-to-year Read more…

Taxes, Financing, Insurance, Scams, and more:

- Insurance Institute ranks Fla. No.1 for building codes Read more…

- Tax reform may be boosting demand for Fla. real estate Read more…

- ‘Nonprime’ loans expand mortgage options Read more…

- Tax cuts aren’t good news if you are planning on getting a mortgage Read more…

- Want flood insurance before hurricane season? Apply now Read more…

Cape Coral and SW Florida News:

- Cape Coral discusses plan for an outdoor event center Read more…

- New grocery stores sprouting in SW Florida Read more…

- FDOT to construct 5 miles of new sidewalks in Cape Coral Read more…

- Cape Coral offering virtual inspections on seawalls damaged by Hurricane Irma Read more…

- Why you should expect a shorter commute in Cape Coral Read more…

- Bimini Basin final plans released Read more…

- Cape Coral desirable for Business Owners and Residents alike Read more…

- Retiring? Where does $1M last longest in Fla.? Read more…

- Lucky’s Market grocery to anchor new plaza at Santa Barbara and Veterans Pkwy Read more…

Real Estate Tips:

- 30 Tips for increasing your Home’s value Read more…

- 12 Home Improvement ideas for DIY beginners Read more…

Nature and Parks:

- Park yourself at these hidden gems in western Cape Coral Read more…

- Eagle Skate Park doubles attendance Read more…

———————————————————-

April’s FEATURED HOME:

2228 NW 25TH ST, Cape Coral – POOL & FURNISHED and priced at $259,900…

A Buyer’s Dream! Home comes beautifully FURNISHED!!! From the moment you walk into this home you will see that it has been well cared for and is clean as a whistle. OPEN FLOOR PLAN design with Great Room as you walk in the front door. Kitchen with GRANITE & STAINLESS APPLIANCES. Dining area with sliders looking out over the POOL. Paver pool deck. TILED THROUGHOUT!!! Master bedroom retreat offers TWO WALK-IN CLOSETS. Granite in bathrooms. Split bedroom floor plan offers Master on one side of the home and guest rooms on the other for the utmost privacy. Bathroom with access to the pool for convenience. Laundry room has shelving and closet for storage and WASHER & DRYER included. Roman style Pool NEW in 2014. a/c NEW in 2016. PRIVATE manicured backyard with SOUTHERN EXPOSURE. Big beautiful palms in the front yard give this home stunning curb appeal. County website shows this property does NOT REQUIRE FLOOD INSURANCE and your insurance company will be happy to hear that this home comes with STORM SHUTTERS. Only 4 miles from an 18-hole Championship Golf Course and easy access to Fort Myers International Airport, which is only about 24 miles away.

2228 NW 25TH ST, CAPE CORAL FL

Click here to see more…

———————————————————-

———————————————————-

“Backyard News”

Nearly 50% of all sales in Cape Coral are at below the $300k price mark, if homes are valued within this range the average months of inventory is less than 3mo., an indication of a strong seller’s market.

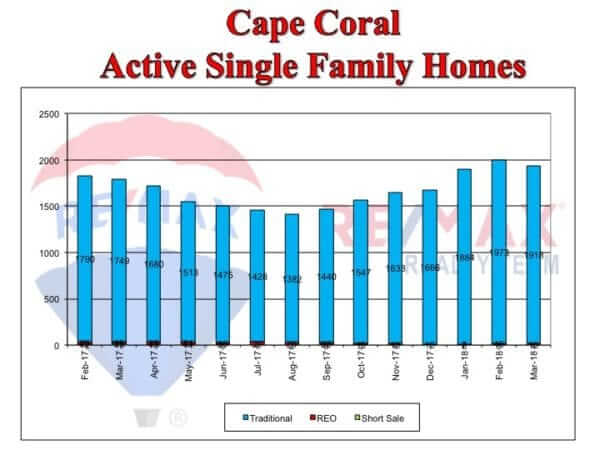

- Although Cape Coral witnessed a much expected and welcomed drop in active inventory, single family homes remain unusually high as we begin Q2, with the highest levels in over 4 years.

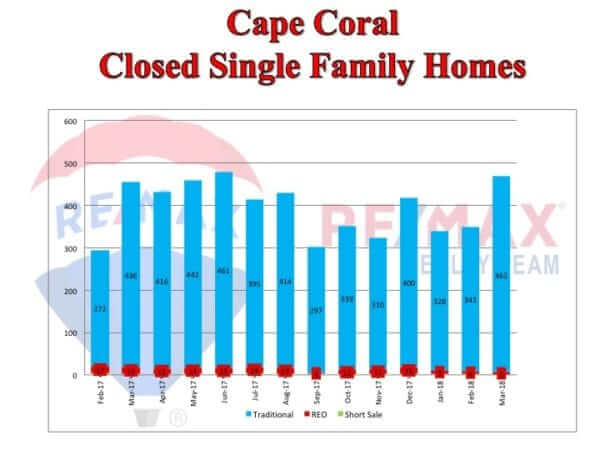

- 468 single family home sales in March, total sales were up 18% from the 2017 first quarter. Distressed sales well within normal market trends.

- Cape Coral home sales are well within the “sweet spot” of just under $300k. The average home for March sold for $280k, a drop of 3% from last year.

- Active single family homes in Fort Myers total nearly 1,800, while this market did see a drop from the month before, a drop of 4% is more in line for this time of year not the 1% we experienced.

- Three consecutive months of sale increases for Ft. Myers, the total for March was almost 400.

- Sustainable appreciation and growth, both great signs for a stable market. Inventory levels down from a buyers market to a neutral one.

“Industry News”

- US Subprime loans may be making their way back in. Issuance of securities backed by riskier US mortgages roughly doubled in the first quarter from a year earlier Issuance of securities backed by riskier US mortgages roughly doubled in the first quarter from a year earlier. At this time, they are not eligible to be bought by Fannie Mae or Freddie Mac, the government-backed mortgage enterprises, or to be insured by the Federal Housing Administration, which supports first-time buyers. However, it’s only a matter of time before loan officers begin learning about the availability of the realtors and borrowers that there is more credit available. An Atlanta, Georgia-based firm, is presently marketing a $ 329m non-QM deal, with one-tenth of the loan portfolio, which is concentrated in Florida, Georgia and California, comes from borrowers whose credit reports show multiple delinquencies within the past year, according to DBRS (global credit rating).

- Nearly $124 million for affordable housing projects – Affordable housing programs will receive close to $124 million from the state and local government housing trust funds. These funds go a long way in helping Floridians achieve the dream of home ownership with down payment assistance. They also provide rental assistance and housing rehabilitation to Florida’s homeless population, veterans and persons with disabilities.

- Post Irma insurance gaps in coverage: There are a larger number for Homeowners associations (Town homes or attached villas) that claim they are like condos. Whereas associations are claiming damage is at the expense of unit owner but the standard condo policy states it’s the associations responsibility. How can you mitigate these pitfalls? Get a full home policy which will provide over lapping coverage.

o Option 1: There is a gap OR

o Option 2: Have duplicate coverage in some areas, but coverage for all the gaps.

“Happy News”

- The Real Trends and America’s Best Agents, will announce the following: Albert Baeza, Deb Cullen and Jay LaGace of REMAX Realty Team as the 2017 Residential Transaction and Volumes top 1000 in the U.S.!