Cape Coral Florida Real Estate news

October 23, 2016

State and National News:

- Which groups will influence future housing trends Read more…

- ATTOM: The foreclosure crisis is over Read more…

- Homebuyers no longer have a taste for McMansions Read more…

- How will Florida grow? UF map shows options Read more…

Taxes, Financing, Insurance and more:

- Owners may qualify for mortgage principal reduction Read more…

- FEMA flood insurance may see climate change revamp Read more…

- Average 30-mortgage rate rises to 3.47% Read more…

- Average time to close? 46 days Read more…

Cape Coral and SW Florida News:

- The 10 best places to retire with only a social security check Read more…

- 5 things about Cape Coral Read more…

- Chiquita lock inching towards removal Read more…

- Removal of Chiquita lock nudges forward Read more…

- Oktoberfest kicks off in Cape Coral Read more…

- New condo tower planned in downtown Fort Myers Read more…

- Buyers are flooding into these 10 Markets Read more…

- 5 Fla. cities rank in top 30 for economic growth Read more…

- Here are the 25 cities with the biggest rent hikes right now Read more…

Real Estate Tips:

- Fabulous Fall Decorating ideas Read more…

- 10 Things you should never paint Read more…

- 8 Things to keep in mind as you renovate your home Read more…

Nature:

- Solar town applies to develop Lee Read more…

———————————————————-

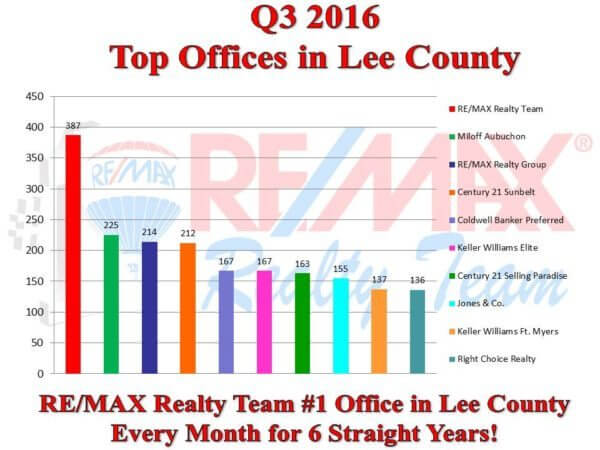

REMAX Realty Team #1 in Lee County again! Thank you to all our WONDERFUL Customers!

———————————————————-

THIS MONTH’S FEATURES:

435 NW 38TH AVE… STUNNING Gulf Access Waterfront Pool Home

Stunning GULF ACCESS energy-efficient home with OPEN FLOOR PLAN and great boating access. Three separate living areas offer a great IN-LAW SUITE potential. One wing has a full bath, separate bedroom and large living room with roughed in plumbing. No need for an in-law suite? Then it’s a great place for the kids, craft suite, upscale man cave, you name it. Countless features in the home like: Tile in main areas, bamboo flooring in bedrooms, TILED ROOF, insulated wind-resistant windows in most of the home and remote electric shutters elsewhere, high ceilings with CROWN MOLDING, whole house reverse osmosis system offers pure clean water from every faucet, video security, 8’ doors, OVERSIZED GARAGE, newer a/c, PLANTATION SHUTTERS, enter the laundry room from either the kitchen or the master bedroom, STAINLESS STEEL appliances, large kitchen pantry, French doors leading into the private office, pocket slider, MANABLOC plumbing, WRAP AROUND DOCK with 10k lift. Imagine taking a stroll around your TRIPLE OVERSIZED HOMESITE and picking a mango along the way. Come take a dip in your SOLAR heated pool with NEGATIVE EDGE or lie back in the spa and let the bubbles take you away…

Click here to see more…

———————————————————-

“Backyard News”

· Traditional sales increase by 6% over the third quarter in 2015, while distressed sales plummeted over 60%.

· The Cape Coral and Fort Myers total distressed sales make up less than eight percent of the market.

· Cape Coral closed 393 single family homes in September, none were Short Sales and 17 were REO’s.

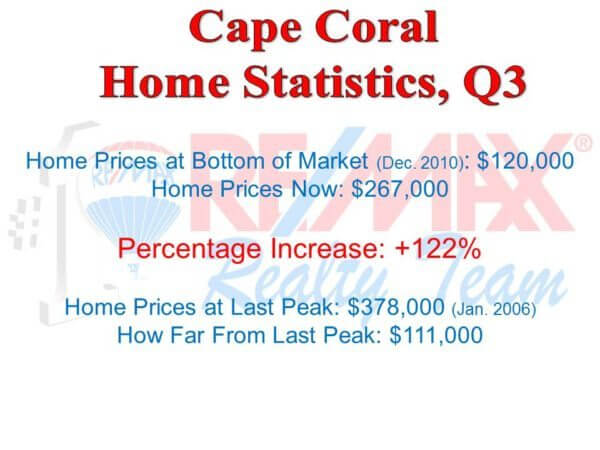

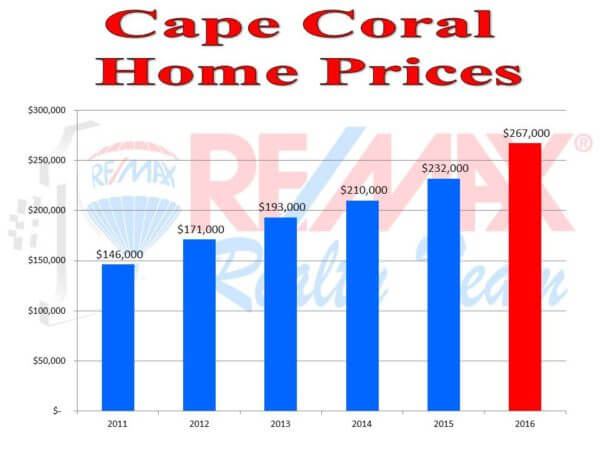

· Prices continue to rise in Cape Coral, with the average sales price topping at $267k, a fifteen percent increase in one year.

· Cape Coral currently has over 1400 single family units for sale, and approximately 100 (or 8%) are under $200k

· Although inventory is up (slightly), Q3 2016 finished with 3.8 months of inventory indicative of a seller’s market.

“Industry News”

· SCAM ALERTS: More title companies are falling prey to the latest wiring scam, please communicate with your clients and let them know NOT to wire any funds without your prior approval/notification.

· SCAM ALERTS: Property Owners may now be receiving “Notices” from their “Servicer” stating that the property has been determined abandoned and or vacant and locks are being changed.

· Fannie Mae is now allowing for a borrower with no credit score to be used as co-borrower. Before they needed to have a credit score.

The main borrower needs to have a 620 credit score.

· Housing demand continues to rise rapidly, while appraisers have shrunk by 22 percent, causing significant delays, cost increases, and rate [locks] expire.

· Ironically, the decline in new appraisers is largely due to new regulations designed to safeguard both banks and borrowers that were put in place at the end of 2008 by Fannie Mae, Freddie Mac and the FHA, as the entire mortgage banking community was under strict scrutiny after the financial crisis. They changed the rules that would allow appraiser apprentices to do full appraisals and instead require the licensed appraiser to be on-site for the inspection.